JUMP TO TOPIC

Sales Tax|Definition & Meaning

Definition

The sales tax is an amount (usually a percentage) charged by the government that the customer pays in addition to the sale price for some product or service. Depending on local laws and the type of offered discounts, it may be charged on either the original price (before the discount) or the sale price (after the discount). Discounts do not apply to the sales tax.

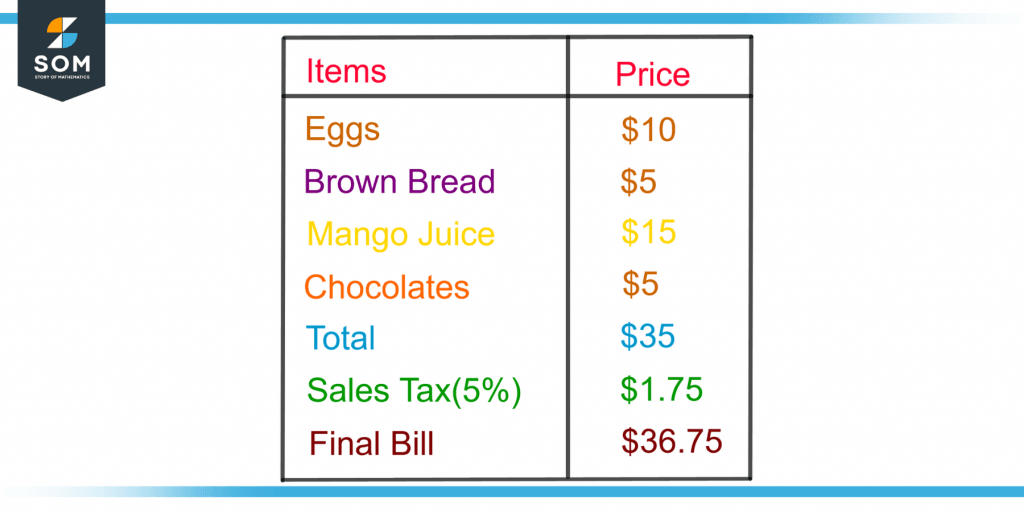

Figure 1 shows the sales tax at the end of a grocery bill.

Figure 1 – Demonstration of Sales Tax on a Grocery Bill Receipt

The Concept of Sales

Sales are tasks related to the selling of goods or the number of goods sold in a given time period. To charge for delivery of service is also called a sale. The process of a sale requires both a buyer and a seller.

Seller and Buyer

The seller is the provider of services or goods, and the buyer acquires the services or purchases the goods at the point of sale. The item’s ownership is passed from the seller to the buyer at a price settled by the seller. A person who sells a product on behalf of the owner is known as a salesperson in an indirect interaction between the seller and the buyer.

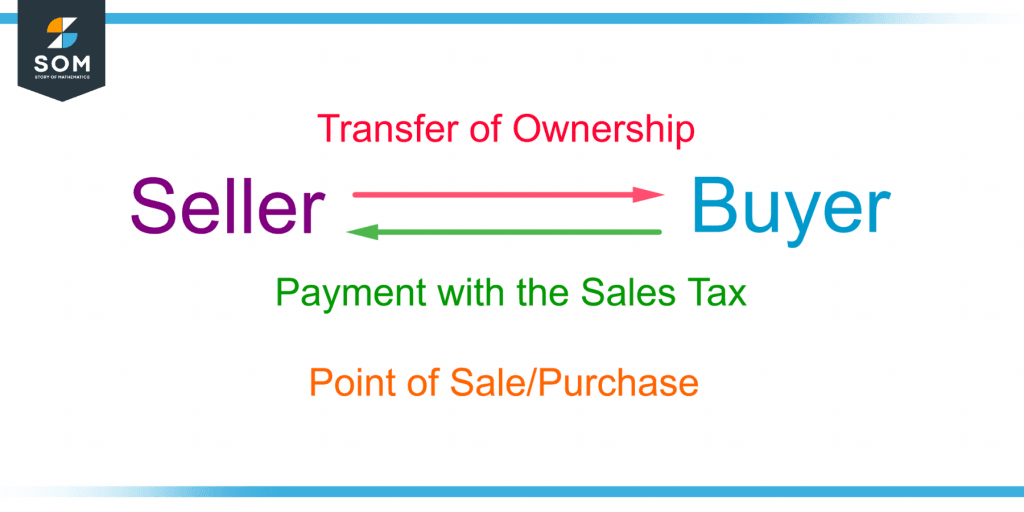

The seller is also known as a retailer, and the buyer is a customer. Figure 2 shows a seller and a buyer and the interaction between them at the point of sale.

Figure 2 – Demonstration of the Roles of Buyer and Seller at the Point of Sale

The transaction is performed on the purchase of a product, and the price for the product, along with the sales tax, is paid to the seller by the customer.

Sales tax is added to the sale price for the product being sold or the service being delivered. This tax goes to the government indirectly from the seller, which is paid by the buyer at the point of purchase or the point of sale.

Why Is Sales Tax Required?

Sales tax plays an essential role in generating revenue for a government. The government uses this revenue on infrastructure development, such as railways, roads, dams, and bridges; on health care, such as in hospitals and clinics; on education, such as in schools and universities and on civil and defense services.

Sales tax is an important source of income for a government. It is also applied to goods such as food and clothing and common services such as hairdressing and dry cleaning.

Taxes such as income and property tax are different from sales tax as these taxes are due on a yearly or quarterly basis, whereas sales tax is paid at the time of the transaction.

Different states have different sale tax, e.g., California has the highest rate of statewide sales tax of 7.25%, whereas Colorado has the lowest sales tax rate set at 2.9%. In some states, sales tax is added to the product’s price and is not mentioned separately, so the customer does not see the change in price while still paying the sales tax.

Types of Sales Tax

There are different forms of sales tax depending on how they are applied. Some sales taxes are included in the price of the goods, some are itemized at the point of sale, and some are varied according to the rate of production level of the product. The types of sales tax are discussed as follows.

Manufacturer’s Sales Tax

The tax paid by the manufacturer of a product to the government is known as the manufacturer’s sales tax. The sale of the product manufactured by a producer is applied to a manufacturer’s sales tax.

Wholesale Sales Tax

The wholesale sales tax is the tax applied to individuals selling similar items in bulk. The wholesaler buys the products from the manufacturer in large quantities. The wholesaler is obligated to pay tax to the government for this consumption of the products.

Retail Transaction Tax

A retail transaction tax is applied to a service or product sold by a retailer to a consumer at the time of the transaction. It is also known as General Sales Tax(GST).

The product at a retailer’s shop is not manufactured by the retailer and has been bought and sold many times before. Each time it is bought and sold, a different type of sales tax is paid by the consumer; hence the retail transaction tax is the highest of all the taxes paid before on the product.

For example, the shoes at a retail store have a retail transaction tax. It has been taxed before by the manufacturer of the shoes, who sold them to a wholesaler. The wholesaler then sells some shoes to a retailer at a greater price again with a tax.

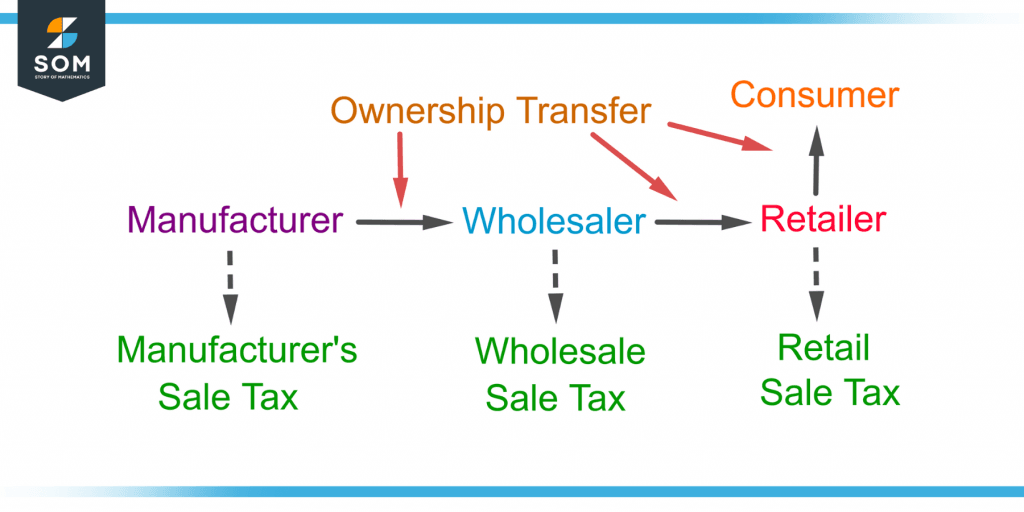

At last, the retailer sells the shoes to the customer with a retail tax at a higher price. Figure 3 shows the transfer of products between the manufacturer, wholesaler, and retailer and the related tax.

Figure 3 – Demonstration of the Applicability of the Sales Tax on the Manufacturer, Wholesaler, and Retailer

To understand GST, consider an example. Product C has a price of \$20 at a retail shop with a GST of 5%. The customer buys product C at \$21, with \$20 for the product and \$1 as GST.

Consumer Excise Tax

The taxes imposed on a business for products when manufactured are known as a consumer excise tax. The retailer does not pay this tax. It is usually imposed on products that are hazardous to health, such as alcohol and cigarettes. It is usually paid for by wholesalers or manufacturers. The purpose of this tax is to discourage the production of such products that are injurious to health.

The business owners pay the excise tax by putting it in the price of the product, and it is not differentiated from the actual price; hence the consumer indirectly pays the excise tax.

Security Turnover Excise Tax

A small tax paid on every swap, stock, or any other trade is known as Security Turnover Excise Tax(STET). This tax was levied in order to discourage speculations, i.e., purchasing a product hoping that it will become more valuable in a short period of time in the stock market.

Gross Receipt Tax

A gross receipt tax is also known as a gross excise tax. It is the tax paid by a company on its total gross revenue. The gross receipt tax is very similar to the general sales tax, with the difference that the GST is paid by the buyer at the time of purchase, whereas the gross receipt tax has to be paid by the seller of goods.

The gross receipt tax is listed separately and not included in the original price of the item in the bill.

Use Tax

A use tax is a tax levied by numerous states in the United States. It is applied when a merchant purchases a product or service and converts it for his own use. The product bought did not have a sales tax when it was purchased initially. The use tax is levied upon the storage, consumption, and use of the products not subjected to a sales tax.

Value-added Tax

The tax that increases incrementally at each stage of the product’s sale is known as a value-added tax or VAT. A value-added tax is a tax percentage added at each stage of purchase from the manufacturer to the wholesaler, to the retailer, and finally to the consumer. The manufacturer’s, wholesale, and gross receipt tax can be considered examples of value-added tax.

The value-added tax is the basic tax that helps generate the most revenue for a government.

Vendor Privilege Tax

The vendor privilege tax is paid directly from the seller, i.e., it is the responsibility of the seller, not the customer, to pay this type of tax. It is collected from the seller and not passed from the consumer of the goods to the state. But the seller adds the tax during the time of the transaction, which ultimately puts the tax on the consumer.

Fair Tax

A fair tax is a sales tax imposed to replace the US income tax.

Turnover Tax

A turnover tax applies to capital and intermediate goods as an indirect tax. It is the tax applied to companies at the time of manufacturing a product which is different from the manufacturer’s sales tax which the manufacturer pays at the time of selling.

Formula for Sales Tax

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. The formula to calculate the sales tax is as follows:

Sales Tax Amount = Initial Price ✕ (Sales Tax Percentage ÷ 100)

The final price that the customer pays will be:

Final Price = Sales Tax Amount + Initial Price

For example, a product A is purchased by a customer having an initial price of \$400 with a sales tax of 8%, the sales tax amount is calculated as:

Sales Tax Amount = 400 ✕ (8 ÷ 100) = 400 ✕ 0.08

Sales Tax Amount = \$32

The final price of product A will be:

Final Price = 32 + 400 = \$432

So, the customer needs to pay \$432.

Advantages of Sales Tax

The sales tax is a major source of revenue that stabilizes a country’s economic and financial conditions. The collection of sales tax is simpler as compared to other taxes, such as income tax. Tax evasion, i.e., the underpayment or non-payment of tax, is very less as compared to other taxes.

It limits the heavy consumption of products that are injurious to health as the sales tax is higher. The sales tax burdens a person to the extent of his/her purchase of a certain product.

Disadvantages of Sales Tax

The sales tax system differs from state to state, which makes the tax structure complex. The sales tax increases the product’s cost, which burdens poor people due to its regressive nature. Double taxation, once on the income and then on a product purchased from the same income, is a major disadvantage on the buyer’s side.

The manufacturer’s profit margin decreases when the sales tax increases the final price. Some sellers get involved in the practice of tax evasion, which is harmful to a country’s economy.

Sales Tax in E-commerce

E-commerce or Electronic commerce is the process of electronically buying and selling products on the Internet in an online environment. The three major types of e-commerce are business-to-consumer, business-to-business, and consumer-to-consumer.

The sales tax for online purchases of items is quite less, i.e., up to 5%, as compared to commerce activities.

Examples of Sales Tax

Some solved examples of sales tax are as follows.

Example 1

A customer purchases cosmetic products at a total price of \$220 in which the sales tax amount, i.e., \$20, is added. What was the sales tax percentage?

Solution

The formula for sales tax is given as follows:

Sales Tax Amount = Initial Price ✕ (Sales Tax Percentage ÷ 100)

For the initial price:

Final Price = Sales Tax Amount + Initial Price

So:

Initial Price = Final Price – Sales Tax Amount

Here:

Final Price = \$220

Sales Tax Amount = \$20

Putting the values gives the initial price of cosmetic products as:

Initial Price = 220 – 20 = \$200

Placing the values in the sales tax formula gives:

20 = 200 ✕ (Sales Tax Percentage ÷ 100)

20 ✕ 100 = 200 ✕ Sales Tax Percentage

2000 = 200 ✕ Sales Tax Percentage

Dividing by 200 into both sides gives:

Sales Tax Percentage = 10%

Hence, the sales tax percentage on the bought cosmetic products is 10%.

Example 2

A customer buys product D for \$500 with a 12% sales tax from a retailer’s shop. What will be the final price of product D?

Solution

Given:

Initial Price = \$500

Sales Tax Percentage = 12%

The sales tax formula is given as follows:

Sales Tax Amount = Initial Price ✕ (Sales Tax Percentage ÷ 100)

Putting the values gives the sales tax amount as:

Sales Tax Amount = 500 ✕ (12 ÷ 100) = 500 ✕ 0.12

Sales Tax Amount = \$60

So, the final price of product D will be:

Final Price = Sales Tax Amount + Initial Price

Final Price = 60 + 500 = \$560

So, the final price of product D amounts to \$560.

All the images are created using GeoGebra.