JUMP TO TOPIC

Commission|Definition & Meaning

Definition

A commission is a payment or percent provided by an employer to such an employee for completing a specified task or bringing in new business selling the company’s products or services. Occasionally it is also known as sales commissions or incentives.

An employee’s commission is a portion of each sale based on the item’s cost. Some employees receive a commission along with their regular pay, whilst others exclusively receive a commission. An employee who receives a commission receives a share of the sale as compensation.

- Sales commission

- Recruiting commission

- Finance Commission

- Real estate commission

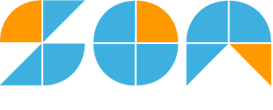

Figure 1-Visual explanation of ten percent commission

Figure 1 above shows the visual representation of the commission. Town Gallery sold a $100 picture of person A with a commission of 10 percent, resulting in person A receiving $90 for the painting and person B getting 10 dollars as a commission.

How Is the Commission Paid?

Depending on the commission’s nature and position, commission payments operate differently. For instance, commissions for salespeople are typically dependent just on the sales they generate. A portion of the earnings of the workers they place earn commissions for the recruiters. Typically, businesses pay commissions on a monthly, quarterly, or annual basis. A company could wish to hold off on paying out the commission till the client signs and completes the purchase agreement and they get the money. The employee that was hired by the recruiter could have to work for the business for a predetermined period of time before receiving a commission in the recruiting industry.

Payment Structures for Sales Associates

There are a few different ways that commissions can be paid. Take into consideration the following frequent types of commission income and what they entail for the worker:

Commission With Salary

When an employee is paid on the basis of salary plus commission, it means that in addition to their regular wage, they also receive a commission. The fact that workers are assured a certain amount of payment through this sort of commission is attractive to them because it does not depend on how much money they bring in through sales. The company typically offers a base income for all of its employees, therefore it is usual practice in the goods sales industry for employees to receive both a salary and commission.

In most cases, an employee who is paid a base salary in addition to a commission must meet a certain sales quota on a quarterly basis in order to maintain their base pay. Employees in these positions are frequently encouraged to strengthen their sales talents in order to increase their quarterly sales numbers.

Direct Payment of a Commission

When an employee’s entire source of income is commission, they are said to be earning “straight commission.” The company determines the amount of the employee’s straight commission based on the total amount of products or services that they sell. When an employee is paid on a straight commission basis, that individual determines how much money they make, which, assuming there is no upper limit on salaries, can be a significant amount.

However, during some times of the year, a company can go through a slow phase, which would have an immediate impact on an employee whose pay is determined solely by commission. As a result of this, businesses advise their staff members to set up a budget for the money they make through commission pay in order to plan for future expenditures. For instance, making money solely through commission is a prevalent practice in the auto sales industry.

Commission of Bonus

Employees that perform above and beyond their standards on a constant basis or at a specific sales time may be eligible for bonus commissions offered by some companies. To motivate their personnel to put in more effort, a medical supplier might, for instance, award bonuses to employees who meet a certain sales goal within the first three months of the year, such as selling 100 units.

The bonus commission is intended to act as an incentive in addition to a method of recognizing employees who contribute significantly to the success of the organization. Although bonus commissions are normally unpredictable and are not typically included in a normal pay structure, some businesses use the appeal of bonus commissions as a tool to entice a more diversified pool of potential employees to join the organization.

Commission With a Graduated Scale

A tiered commission structure places an emphasis on recognizing employees who have demonstrated a particularly high degree of dedication through the use of a leveling system. The amount of work that an employee puts in determines what “level” of commission they receive.

An employee who has improved their performance may be able to move up to the next incentive level, which both further separates them from their peers and delivers a greater financial reward. Commission pay for graduates is often proportional to the number of sales that each employee generates. Tom would be at a greater level than Wendy and most likely receive a bigger reward for his efforts if, for instance, he made 1,000 sales each month while Wendy only made 550 sales.

Commission of Variable

The percentage of an employee’s total sales that constitutes their variable commission income varies with the product or service that they offer. The proportion they receive is determined not by the number of items sold but by the items themselves. For instance, if a real estate agent sells a house, the agent might receive 5% of the entire sales price, which would be 14,000 dollars in this case given the sale price of 280,000 dollars. If, on the other hand, the very same real estate broker sells a building for $1.5 million, the agent may be eligible for a greater commission due to the fact that the structure is not a residence and earns a significantly higher sales price. It is possible that the commission for the agent will be closer to 15 percent of the entire sale price, which would be 225,000 dollars.

Comprehension of the Commission Graphically

The following graphs make it simple to understand the term commission.

Let’s assume that Peter wants to sell his car and He takes it to a car bargain dealership. The dealership will help you in selling your car but they have fixed a 10 percent commission on the total amount. If they sell your car for 1000 dollars, they will charge 150 dollars from you.

Figure 2-A graphic breakdown of the ten percent commission

Assume you want to sell your house, so you contact real estate agents. The real estate agents will assist you in selling your home, but they will charge a commission of 15% of the sales price. They will charge you 700 dollars from you if they sell your house for 5,000 dollars. The figure below explains the entire scenario.

Figure 3-An illustration of the fifteen percent commission

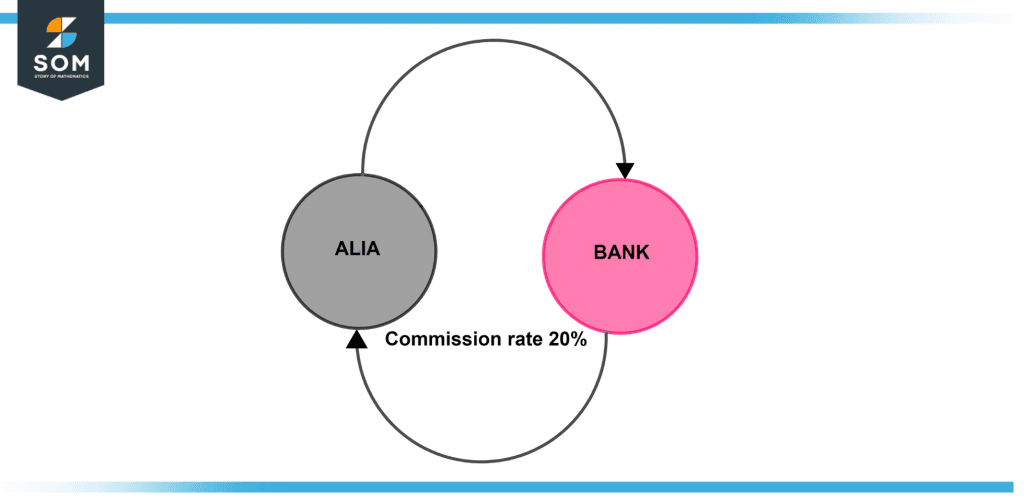

Let’s say that Alia goes to the bank to get a loan, and the bank administration agrees to give her the loan as long as she pays them a commission equal to twenty percent of the total amount. The accompanying diagram offers a graphical representation of the entire event, which explains everything in detail.

Figure 4-Demonstration of the twenty percent commission structure

A Numerical Example of a Commission

What is the 10 percent commission on the amount of 5000 dollars?

Solution

Given that:

Amount = 5000

To find:

10 percent commission on the total amount

To calculate 10 percent of 5000, we know that:

10 percent is equal to 0.1

No multiplying this with the total amount to get 10 percent.

0.1 x 5000 = 500

So, the 10 percent commission of 5000 is 500 dollars.

All images/mathematical drawings were created with GeoGebra.